So, I spent a greater part of my time this past week going through the Ghana Living Standards Survey (GLSS) Round 6 main report and was curiously struck by some of the numbers on income and expenditure patterns in the country. I produce below some extracts and further commentary on income and expenditure patterns in Ghana.

INCOME: In terms of household incomes, the average annual gross household income is about GH¢16,645 while the average per capita gross income is GH¢5,347, implying that an average person lives on an average gross income of GH¢14.65 per day. At the regional level, Ashanti has the highest average gross annual income of GH¢23,120 followed by the Western region and then Greater Accra.

EXPENSES: The annual average household expenditure is GH¢9,317 with a mean annual per capita expenditure of GH¢3,117. On average, a person spends about GH¢8.85 per day.

COMMENTARY: Going by these statistics, the average Ghanaian should be saving GH¢5.8 per day. Now, assuming there are 12 million Ghanaians participating in the labour force with the same labour productivity and holding other factor productivity inputs constant, we should in total be saving about GH¢69.6 million per day or GHC¢25.4bn annually (22.5% of 2014 GDP) assuming we worked all year round. In contrast, during the GLSS5 survey in 2008, most households in Ghana were living beyond their means, as they owed on average GHC¢244 per capita per year. The curious question that arises is: does this represent a modest improvement in living standards?

My good friends Hene Aku-Kwapong, Marricke Gane, Alex Barkers-Okwan and Kobina Nyanteh are inclined not to believe these statistics. They instead succinctly argue that the majority of Ghanaians live “hand to mouth” due to insufficient income, which means many are forced to be spenders than savers due to circumstances beyond their control. Some of the factors catalysing this are high inflation rates currently at 16.9% (an invisible tax); the gross mismanagement of the economy and weak monetary policies, which have created exchange rate volatility to the extent that most workers have been priced out of the mortgage market and forced to rent, sometimes making two-year upfront payments to unscrupulous landlords.

The savings paradox is aptly captured in this comment from Hene Aku-Kwapong:

On average no saving significant enough to make a difference is happening. Why? Personal disposable income + cash from assets (A) – noncash income (B) = Disposable income + Net asset liquidations (C) + Change in consumer credit (D) = household cash flow – debt service and financial obligations (F) – Energy – Food at home – uncovered medical costs = Discretionary cash flow. So, A and C practically zero since no asset market like real estate, B which is retirement set asides practically limited, D non-existent since no credit. So you are left with F that takes away everything and with even a point increase in energy and food, we are left with folks calling abroad for remittances to fill the gap. This is a problem

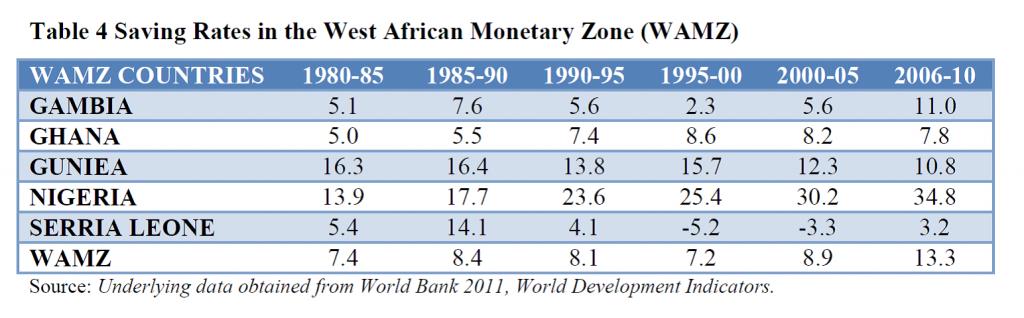

According to the Africa Renewal Magazine, “Sub-Saharan Africa has the lowest savings rate in the developing world …gross domestic savings in the region averaged about 18 per cent of gross domestic product (GDP) in 2005, compared with 26 per cent in South Asia and nearly 43 per cent in East Asia and Pacific countries, according to World Bank estimates.”[1] Clearly, it is evident that a lot more needs to be done to improve on wealth and employment creation.

Source: Arawomo, 2012

Notes:

- Note that there are gross disparities across regions. However, the three Northern regions trail in all income and expenditure categories.

- The labour force defines the number of currently employed persons and employment-to-population ratios (persons 15 years and older)

- Using median estimates would have been a better measure but I am unable to find any in the main report ― only averages are reported. This might be difficult to report unless one gets access to the main data.

Web Links

- http://www.arts.cornell.edu/poverty/kanbur/AryeeteyKanbur.pdf

- http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.20.2836&rep=rep1&type=pdf

- https://www.academia.edu/4354826/EXPLAINING_LOW_SAVINGS_RATE_AMONG_COUNTRIES_IN_THE_WEST_AFRICAN_MONENTARY_ZONE

- http://www.statsghana.gov.gh/glss6.html

- http://www.jstor.org/stable/10.7722/j.ctt81fmh

[1] http://www.un.org/africarenewal/magazine/october-2008/boosting-domestic-savings-africa#sthash.fnuxbIEo.dpuf