On 25 April 2018, delivered a public lecture yesterday as an IMANI Africa @ImaniAfr Fellow on the “Critical Future of Ghana’s Energy Sector and How to Avoid More Surprises to Ghana’s Growth Prospects”. Many thanks to @lordcudjoe and the MANI team for organising this #oilmoneywahala @oilgasghana @benkoku

Video Reports from IMANI’s Fellowship Lecture on the Critical Future of Ghana’s Energy Sector & How to Avoid More Surprises to Ghana’s Growth Prospects. This past Wednesday, IMANI’s centre for the study of energy and natural resources organized a fellowship lecture and panel discussion on the critical future of Ghana’s energy sector & how to avoid more surprises to Ghana’s growth prospects. Below are video and text reports.

Franklin Cudjoe, IMANI President writes:

“My friends, there are rare moments in our lives when we encounter the product of what true education is about. This video is one such product. I implore you to make time to watch it but crucially share it. It is 98% of all you need to know about Ghana’s recent history and its future in the management of power, oil and gas. This would have gained students 15 credit hours in a course in petroleum economics. I am sending copies to the sector Minister, the Vice-President and President’s office.”

Feedback

”Mr. Cudjoe, on behalf of my colleagues, I would like to thank you for organizing this morning’s insightful and interesting lecture, which enabled a lively and open debate.”– Regional Adviser, Sub Saharan Africa, Eni energy company

Watch Dr. Theo Acheampong’s Presentation

Synopsis: The discovery of oil and gas in Ghana was very much celebrated and looked to as a panacea to finally lift the country out of total poverty. Consequently, the share of petroleum to overall economic output increased from 6.7% of GDP in 2011 to 9.3% of GDP in 2014; and over the period 2011 to 2017, about USD4 billion has been accrued to the treasury as petroleum revenues.

However, the multiplier effects of oil production on the economy have been constrained by a combination of factors including declining global oil prices and higher than budgeted oil revenue-based expenditure. New oil and gas projects, including the TEN and Sankofa fields, are expected to result in a six-fold increase in production by 2018 and hence boost revenue amid low oil prices. Beyond this, however, new commercial discoveries have not been made and it is feared that this is likely to have adverse implications for the country’s revenue generation capacity.

In the power sector, Ghana lags in its ability to generate enough power to fuel economic growth. For example, the three-year power crisis in Ghana from 2013 to 2016 resulted in the country losing about 2% GDP annually according to the Institute of Statistical, Social and Economic Research. The rapid deceleration in economic activity was primarily due to persistent energy supply constraints and rising energy-related input costs to production. In the 2018 State of the Nation’s address, the president noted that although the power crisis had been abated, the challenges facing the power sector, predominantly high costs, were far from over.

Key evolving questions given this background include:

Oil and Gas

- What is the evolution of the oil and gas industry in Ghana to date, and what are Ghana’s short to medium term energy policy priorities?

- What are the key barriers to investment in the oil and gas industry, and what policies and institutional frameworks should be adopted to scale up investments in the current low oil price environment?

- What is GNPC’s role in Ghana’s domestic energy sector and what are the political and economic drivers likely to ensure its success given the national oil company’s core mandate?

- How can GNPC attain its policy objectives for the next five to ten years, and how do these objectives or plans fit into the framework of its mandate regarding investments in the oil and gas sector?

- What are the implications of the above for local content, revenue management and integrating the oil and gas industry into the wider economy?

Power Sector

- What is the country’s strategy for increasing energy supply without increasing energy-related input costs to production?

- How will integrated regional gas and power infrastructure projects such as the Sankofa Gas Project in Ghana, the Songon Power Project in Cote d’Ivoire and LNG imports impact domestic gas pricing policies and the electricity tariff pricing structure including contractual commitments in securing commercially-viable offtakers?

- What is the role of market reform and the unbundling of services including the issue of private participation in electricity distribution?

- What is the outlook post-privatization and the implications for economic growth?

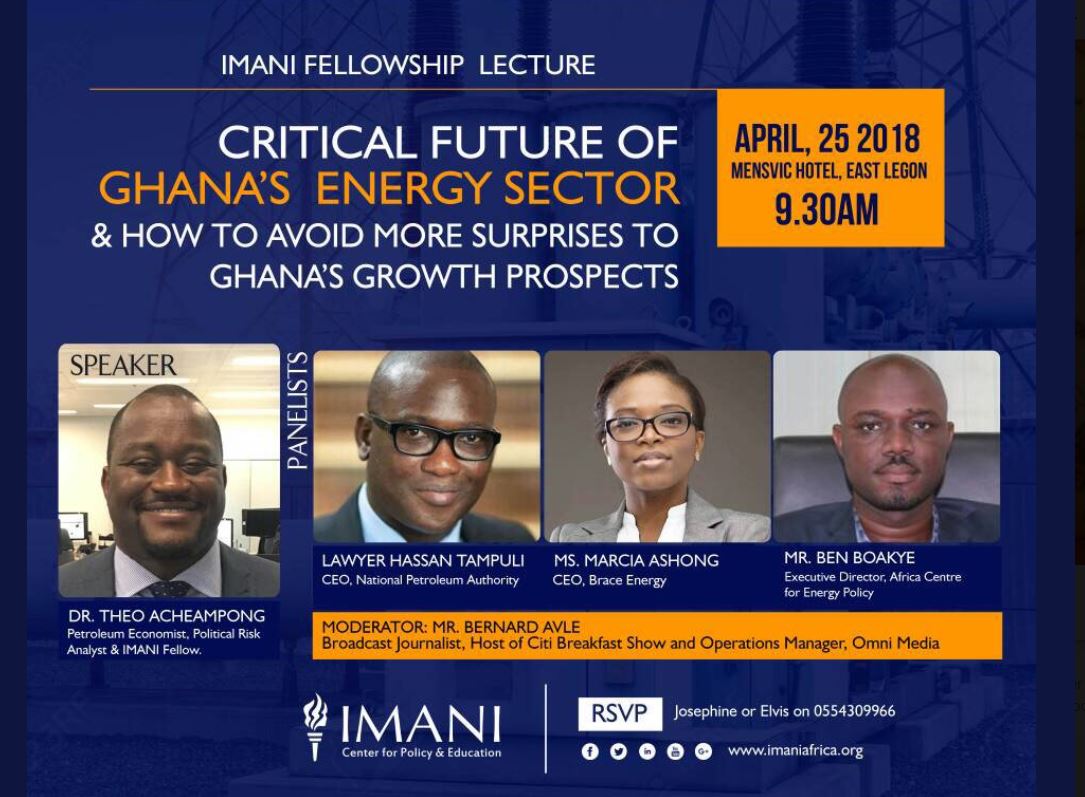

IMANI Africa is inviting you to a public lecture to engage key stakeholders and the public in order to understand these issues, elicit cogent responses and generate ideas that will yield efficiency within the sector. The lecture will be delivered by IMANI fellow, Dr. Theo Acheampong and will be followed by an extensive discussion.

IMANI Africa has been keenly involved in Ghana’s energy sector – oil and gas, and the power sector – given the strategic importance of the sector to Ghana’s economic development.

Event details are as follows:

Date: WEDNESDAY, APRIL 25 2018

Venue: Mensvic Hotel, East Legon

Time: 9.30am PROMPT

Download Presentation Slides at http://www.imaniafrica.org/wp-content/uploads/2018/04/IMANI-Public-Lecture-Final_25.04.18.pdf

News story and additional commentary at https://www.newsghana.com.gh/imani-reports-you-must-read-everything-about-ghanas-energy-sector-and-plans-for-2018/