By Dr Theophilus Acheampong[1]

Key Highlights

| 1. We debate vigorously in IMANI, and that is normal and healthy – I agree with aspects of IMANI’s work on this matter. I took a position as an expert on Newsfile, which was understood by IMANI, but the team weighed that against utterances from Aker, the Ministry of Finance, and the President of Ghana, and decided they will go with the position that Ghana has found new oil. 2. It is likely – and I could be entirely wrong if new technical evidence establishes otherwise – that the so-called discoveries are not new discoveries but an extension of the Pecan development in the same delimited contract area for production and development left by Hess; thus, no new PA is required. This is based on my reading of the Petroleum Agreement, E&P Law and other Legislations. 3. Attempts either through the Plan of Development (PoD) or other means to extend the size of the production and development area to cover all the contract area including relinquished parts of the block, and thus the same fiscal terms would be wrong and must be rejected. |

Introduction

On 25 April 2019, Ghanaian Think Tank IMANI Africa[2] in a press briefing raised some concerns regarding developments in Ghana’s upstream oil and gas industry. IMANI indicated that Ghana could lose several billion dollars of petroleum revenues due to the nature of the Aker Energy-operated Petroleum Agreement covering the Deepwater Tano Cape Three Points (DWT/CTP) block offshore Ghana.

At the core of the argument raised by IMANI is that Aker Energy, on acquiring a 50% operating interest in the said block from Amerada Hess in June 2018, proceeded to conduct additional [exploration] works in the area leading to

“additional oil discovered in Aker’s contract area previously held under an old Petroleum Agreement (PA) which lapsed in 2014, it is our considered view that the additional oil discovered in 2019 are essentially not covered by any of the Petroleum Agreements (PA) in force, hence those additional finds require a new Petroleum Agreement, and should be negotiated under the Petroleum (Exploration and Production) Act, 2016 Act 919.”[3]

The second substantive argument is that

“…Ghana could have exercised its right to take up the 10% additional equity option in the Aker Block.” And that “the failure or refusal or negligence to do this is truly startling for a developing nation which needs to make the most of its natural resources.”[4]

In responding to the issues raised by IMANI, Energy Minister John Peter Amewu and other government agents stated through a press briefing on 26 April that

“…there was no basis for a new PA as claimed by IMANI because the work that was done by Aker Energy formed part of an appraisal programme based on the existing petroleum agreement.”[5]

Preliminary Points

I hope through this op-ed article to provide a bit more clarity to the technical issues raised, more so, given the two different positions of the Ministry of Energy (MoE) and IMANI. Firstly, as someone who believes in transparency and accountability, I would argue that it is not too much for civil society groups and think tanks to ask public officials to clarify their positions on such issues of pivotal national importance. I believe Public officials must have wider latitude for scrutiny, especially when their work comes into question.

Secondly, questions or issues raised by IMANI or indeed any other civic organisation must be commended, as they have become a key bastion in Ghana’s democracy. Without civil society, I daresay most of the information we seek might not be provided or readily available, especially as we have as a country been dilly-dallying with the Right to Information (RTI) law for over 20 years.

DWT/CTP Contractual Terms and Matters Arising

| Original Contract Area Size | 2,100 sq.km |

| Effective Date | 19 July 2006 |

| Exploration Period | Seven years: three (3) years initial plus two (2) years (first extension) plus two (2) years (second extension) |

| End of Exploration | 19 July 2013. But can be extended by agreement between contractors and government subject to clearly defined work programme. Section 3.2(d) of 2006 PA provides grounds (exploration period extension). |

| Discoveries | Seven (7) discoveries namely Pecan North, Almond, Cob, Beech, Pecan, Paradise and Hickory North were made during the period necessitating appraisal. Submit an appraisal plan within 180 days of discovery (Article 8.4 of PoD) and partners have three years from the date of discovery to complete appraisal programme. |

| Appraisal | Three years amounts to 19 July 2016. |

| Maritime Border Dispute/ITLOS | Commenced 21 November 2014 whereby Ghana instituted arbitral proceedings under Annex VII to the United Nations Convention on the Law of the Sea (hereinafter “the Convention”) in “the dispute concerning the maritime boundary between Ghana and Côte d’Ivoire”. On 12 January 2015, the Tribunal decided to accede to the request of Ghana and Côte d’Ivoire to form a special chamber of five judges to deal with the dispute concerning the delimitation of their maritime boundary in the Atlantic Ocean First ruling on provisional measures on 30 March 2015 said, “Ghana shall take all necessary steps to ensure that no new drilling either by Ghana or under its control takes place in the disputed area” Comment: Although ITLOS did not necessarily affect Hess’ appraisal work program it did significantly affect them bringing in a PoD. No one would make an FID in such turbulent times. Subsequent ITLOS ruling in favour of Ghana in September 2017. |

| Extensions granted | Ten (10) months post ITLOS ruling to submit Plan of Development (PoD) – July 2018 for Hess to submit PoD Hess did some appraisal work and asked for an extension in submitting the PoD and this was granted. The timeline passed without Hess submitting the POD. In 2018, Hess sold their interest to Aker and Aker reopened the appraisal programme. In June 2018 Aker Energy Ghana AS, a subsidiary of Aker Energy AS (“Aker Energy”) completed the acquisition of Hess Ghana, the operator of the Deepwater Tano Cape Three Points block (“DWT/CTP”) with a 50% participating interest in the license. Another extension granted to submit PoD which includes a plan by Aker to conduct further appraisal drilling |

| Status of Operations | Hess completed appraisal and declared commerciality for Pecan, Almond and Beech oil discoveries. A conceptual development plan was agreed on for reserves including initial FEED and FPSO options. About 69% of the Contract Area was affected by the ITLOS ruling. The then Minister for Petroleum in June 2016 granted Contractor ten (10) months post the maritime boundary ruling extension to submit a Plan of Development for the commercial fields. |

Source: Ghana Petroleum Register[6]

Substantive Issues

The analysis below is restricted to publicly available documents namely:

- PA signed in February 2006 by Hess and inherited by Aker in June 2018;

- E&P Law (Act 919);

- Petroleum (Exploration and Production) (General) Regulations, 2018 (LI 2359); and

- Official press releases by Aker and the Ministry of Energy (on their websites).

Source: SPE, 2018.[7]

(A) Is the US$30billion gross valuation of the field, right?

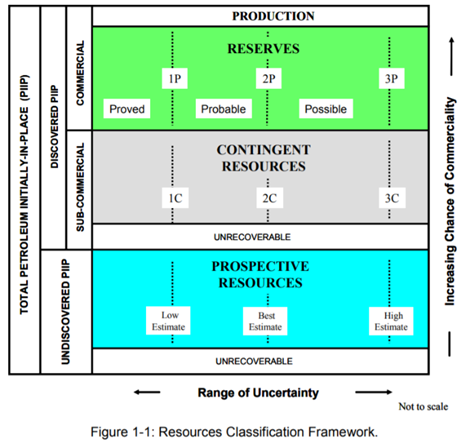

At the core of the question of US$30 billion gross valuation of the field is understanding the difference between resources and reserves.[8] According to both the British Geological Society (BGS) and the Society of Petroleum Engineers (SPE), resources (contingent) are the total quantities of petroleum (oil/gas) which are estimated, on a given date, to be potentially recoverable from known accumulations, but which are not currently considered to be commercially recoverable.[9] Reserves, on the other hand, are defined as those quantities of petroleum which are anticipated to be commercially recovered from known accumulations from a given date forward.[10] Hence, Resources ≠ Reserves! We start from resources and then apply the relevant technological and economic factors to arrive at reserves.

The Energy Minister questioned IMANI’s valuation of the field at US$30 billion – that is, US$65 per barrel in real terms multiplied by 450 million barrels of oil equivalent (boe) reserves saying it “exposes the weaknesses in IMANI’s analyses as well as its poor understanding of petroleum economics”.[11] The Minister claims that the 450 million boe are gross contingent resources (that is, they cannot be fully recovered) and besides, in Ghana, our average oil recovery rate is 25%. Therefore, using this rate, translates to 112.5 million boe, leading to an estimated field valuation of US$7.3 billion, assuming a long-term price of US$65 per barrel in real terms. However, a closer introspection of this also reveals this assumption is also not factually accurate. Why? A statement by Aker Energy on 26 April 2019[12] announcing the completion of the drilling campaign states that

“…Reserves, to be developed in the first phase, are estimated at 334 million barrels of oil. Discovered contingent resources, to be developed in subsequent phases, are estimated at 110-210 mmboe, resulting in a combined volume base of approximately 450–550 mmboe. These estimates exclude any additional volumes from Pecan South and Pecan South East, currently being assessed.

Aker Energy does not only make a clear distinction between reserves and contingent resources but proceeds to use the phrase “to be developed in the first phase” with additional upside. Also, there is a clear distinction between RESERVES (commercially exploitable with current technology and at current oil prices) and RESOURCES (upside) which is consistent with SPE and BGS definitions. Besides, Hess’ prior appraisal of the field put the 2P (proven plus probable) reserves of Pecan at ~250mmboe. This is likely what has been upped to 334 mmboe by Aker through the additional appraisal drilling. Thus, IMANI’s US$30bn gross valuation is consistent with Aker’s statement and other official government releases indicating “potential recoverable reserves of nearly one billion barrels”.[13]

(B) Does new work carried out by Aker Energy constitute appraisal or exploration operations, and will Ghana lose out?

The major bone of contention is that the new discoveries, which were officially announced by Aker, a few months ago in various official press releases, fall outside the original petroleum agreement terms – both the exploration and appraisal periods have elapsed. So, if the agreement is renegotiated as per the Petroleum (Exploration and Production) Act, 2016 (Act 919) and Petroleum (Exploration and Production) (General) Regulations, 2018 (L.I. 2359), then Ghana stands to gain an estimated US$9 billion, through potentially 25% to 30% increased equity interest and royalties.

Therefore, it is argued that Ghana should pursue drafting and signing of a new Petroleum Agreement as demanded by Act 919 for these new discoveries. Both IMANI and the main opposition National Democratic Congress (NDC) claim[14] that a new PA for any new exploration leading to a new discovery will give the State enhanced fiscal terms, including at least a 10% Royalty, plus a minimum of 15% Carried Interest as stipulated by law, highlighted in the table below.

| FISCAL PACKAGE & ANALYSIS | 2006 PA | Potential New PA |

| Royalty Oil and Gas | 3%-4% | 5%-7% |

| Initial GNPC Participation | 10% | 15% |

| Additional Participation | 3% | 5% |

| Sub Total | 17% | 27% |

| Petroleum Income Tax (PIT) | 35% | 35% |

| Additional Oil Entitlement (AOE) | 5%-20% subject to after-tax internal rate of return (IRR) | 5%-20% subject to after-tax internal rate of return (IRR) |

Answering yes or no to the above requires one to comprehensively assess, based on the petroleum agreement and work programme, whether new work carried out by Aker constitutes appraisal drilling (that is, in continuation of the old PA and extensions granted under that) or finds are new discoveries as per exploration operations. The critical questions of note here are:

- What are the current dimensions of the discovery area (and potential production area) for the Deepwater Tano Cape Three Points (DWT/CTP) block offshore Ghana?

- What was the objective of the four-well new drilling programme by Aker approved by the Petroleum Commission for Pecan-4A, Pecan South and Pecan South East?

- What are the exact locations of the four new ‘appraisal’ wells and what is the status of the appraisal report?

- Are the Pecan-4A and Pecan South wells linked in any way (geologically) to the main Pecan field reservoir — that is, is this an extension of the same reservoir or not? Besides, within the same field or not?

- What is the position of the Petroleum Agreement, Act 919 and other Regulations on the classification of exploration or appraisal wells including new exploration activity during the appraisal period?

- What should be the fiscal treatment for any new exploration within the same development and production area leading to new discoveries?

According to Article 1.26 of the PA signed by Hess and inherited by Aker, a “Discovery“ means “finding during exploration operations an accumulation of petroleum whose existence until that finding was unproved by drilling, which can be or is recovered at the surface in a flow measurable by conventional international Petroleum industry testing methods”.

Furthermore, Article 1.29 defines “Exploration” or “Exploration Operations” to mean searching for petroleum by geological, geophysical and other methods and the drilling of exploration wells and

includes any activity in connection with or in preparation thereof and any relevant processing and appraisal work, including technical, and economic feasibility studies, that may be carried out to determine whether a discovery of petroleum constitutes a Commercial Discovery.

Additionally, Article 1.2 defines “Discovery Area” to mean “portion of the Contract Area, reasonably determined by Contractor on the basis of the available seismic and well data to cover the areal extent of the geological structure in which a discovery is made. A discovery area may be modified at any time by [the] Contractor if justified on the basis of new information, but may not be modified after the date of submission of a report [“Appraisal Report”] under Article 8.7”.

Likewise, Article 1.14 defines “Contract Area” as “the area [in the concession] in which Contractor is authorised to explore for, develop and produce petroleum, but excluding any portions of such area in respect of which Contractor’s rights hereunder are from time to time relinquished, or surrendered”

Also, the Article 1.5 and 1.6 of the PA defines “Appraisal Programme” as a “programme carried out following a Discovery of Petroleum for the purpose of delineating the accumulation of Petroleum to which that Discovery relates in term of thickness and lateral extent and estimating the quantity of recoverable Petroleum; therein; ”Appraisal Well” means a well drilled for the purposes of an Appraisal Programme.

An analysis of the above provisions indicates that discoveries can be made during exploration operations; however, exploration or exploration operations are time-bound to the exploration period, which is seven (7) years, in this case, ending on 19 July 2013 or any new extended date by agreement between contractor(s) and the government subject to a clearly defined work programme.[15] Appraisal work can take place during exploration operations once a discovery is made, but exploration operations often do not take place during appraisal works. Exploration operations are confined to the exploration period or extensions provided for in a petroleum contract.

Therefore, any explicit exploration work outside this period by a contractor likely indicates major regulatory failure by the institutions involved in issuing permits including the Ministry of Energy. Once the exploration period ends, any discoveries made during which are not fully appraised move to the appraisal stage. The appraisal period and activities therein are also defined in the petroleum agreement, which in this case, is three (3) years from the date of discovery to complete the appraisal programme. The appraisal programme includes drilling of appraisal wells to find out the size (lateral extent), thickness and estimate the quantity of recoverable petroleum in a discovery.[16] It is almost impossible for companies to carry out new exploration operations beyond the stated period and outside of the development area unless sanctioned by relevant bodies.

My understanding of the issue is that the work was carried out within the same development and production area. The original intent of the appraisal work undertaken by Aker Energy in November 2018, leading up to the submission of an integrated Plan of Development and Operations (PDO) on 28 March 2019 states that:

“… [it] was to verify the partners’ understanding of the area and to prove up additional resources to further strengthen the Pecan field development. The recent appraisal drilling campaign has contained of three appraisal wells and a side-track well.”

It is important to note that the signing of a final investment decision (FID) in the oil and gas industry is contingent on successful appraisal work. Exploration period had already expired back in 2013 and 3-year appraisal period also expired; however, both Hess and now Aker were given extensions to their appraisal campaign. Work done is appraisal of the same reservoir structure and “identified deep oil/water contact”. In my opinion, it this does not constitute a new discovery which merits a new PA.

The argument made by IMANI is perhaps grounded in Act 919 and Section 27(2) of L.I. 2359 which states that

“Where a contractor wishes to carry out exploration activities within a development and production area of an existing petroleum agreement, that contractor shall apply for a new petroleum agreement.

It would be highly unusual that the contractor would be carrying out exploration activities for something which the legally defined period had elapsed and discoveries made; it was not new exploration but likely appraisal of the existing (Pecan) discovery, which meant drilling extra wells to complete the appraisal works before moving to an FID.

This notwithstanding, the other point to note is, if Hess did complete the appraisal work for the Pecan discovery, signalled by the submission of the appraisal report as per Article 1.2, then Aker’s new discovery area, to the extent that the area was not mapped or included in the said appraisal report, cannot be part of the production and development area it legally inherited from Hess. If the appraisal work was not completed, then the new discovery area can be modified, and by extension, the new production and development area as per Article 1.2.

So, the fundamental question is: did Hess fully complete their appraisal work and submit an appraisal report, indicating completion of appraisal works, before they sold out the field to Aker Energy? If Hess submitted an appraisal report, the appraisal period is over. Therefore, the new work undertaken by Aker, and the consequential expanded volumes, even from the same geological structure, likely constitutes a new discovery. The question that arises then is how to share the new reserves among the partners – that is, subjecting this to a new PA with improved fiscal terms or the old PA. Another point of consideration would be whether the new discoveries are geologically connected (straddle) to the original Pecan field, requiring a unitisation agreement for development with pro-rated volumes, or standalone compartmentalised reservoirs – all of them being subjected to the same or separate fiscal treatments.

Final Thoughts

We debate vigorously in IMANI, and that’s normal and healthy. Indeed, I agree with some aspects of IMANI’s work on this matter. I took a position as an expert on Newsfile, which was understood by IMANI, but the wider team weighed that against utterances from Aker, the Ministry of Finance, and the President of Ghana, and decided they will go with the Aker and Government position that they had found new oil. Nonetheless, I have read the Petroleum Agreement, E&P Law and other legislation in detail, and it is likely (I could be entirely wrong if new technical evidence establishes otherwise) that the so-called discoveries are not really new discoveries but an extension of the same Pecan development in the same delimited contract area for production and development left by Hess. Thus, no new PA is required.

There is also claim that Aker proposes that the implementation of the PoD is made conditional that “the subsequent developments of petroleum resources within the Development and Production Area shall be subject to the same fiscal terms as for the DWT/CTP Pecan field development.” This is standard industry practice. Conventional practice is that the fiscal treatment should not materially change if subsequent discoveries are made in the same contract area; more so if the fiscal system is efficiently and effectively designed to capture the upside of more discoveries, reducing costs or rising oil prices.

Also, one needs to consider the stabilisation

provisions in such contracts and potential lengthy arbitration battles. Any

such significant fiscal change disincentivises future investments. However, attempts

either through the PoD or other means to extend the size of the production and

development area to cover all the contract area including relinquished parts of

the block, and thus the same fiscal terms would be wrong and must be rejected.

Hess relinquished significant parts of the contract area back to the government

save for the discovery area, and this should form the basis for any new PA

award with improved fiscal terms as per Act 919.

[1] Dr Theophilus Acheampong is a petroleum economist and political risk analyst with extensive knowledge and experience in strategic advisory, regulatory and commercial issues in oil and gas, energy and mining. His work focusses on economic and investment analysis as well as research and advisory in fiscal regime modelling, contractual negotiations, hydrocarbon accounting, and macroeconomic and policy analysis.

[2] Of which I am affiliated with as Non-Resident Senior Fellow

[3] https://imaniafrica.org/2019/04/24/imani-alert-ghana-discovers-africas-biggest-oil-deposit-but-may-lose-billions/

[4] Ibid

[5] https://www.primenewsghana.com/business/imani-lied-about-us-4-4bn-aker-energy-deal-peter-amewu.html

[6] https://www.ghanapetroleumregister.com/deepwater-tano-cape-three-points

[7] https://netherlandsewell.com/wp-content/uploads/2018/09/SPE_Petroleum_Resources_Management_System_2018.pdf

[8] Net valuation considers the significant investments required to recover and produce the resources – that is, it isn’t just the revenue side of the equation. Investments (capex), operating costs (opex) and time value of money (to reach a Net Present Value) are factored.

[9] https://www.spe.org/industry/petroleum-resources-classification-system-definitions.php

[10] https://www.ogauthority.co.uk/media/2784/resources_vs_reserves_-_note_-_27-6-13.pdf

[11] https://www.ghanaweb.com/GhanaHomePage/NewsArchive/IMANI-has-poor-understanding-of-petroleum-economics-Energy-Minister-741952

[12] https://www.akerenergy.com/news/archive/2019/aker-energy-completes-appraisal-drilling-campaign-offshore-ghana-continues-work-on-pdo

[13] http://mofep.gov.gh/sites/default/files/news/Press-Release-Ghana-oil-production.pdf

[14] https://citinewsroom.com/2019/04/25/ghana-likely-to-lose-7-2-billion-over-aker-oil-find-minority/

[15] Article 3.2(d) of 2006 Hess/Aker provides grounds (exploration period extension)

[16] Article 8.5 of 2006 Hess/Aker PA